Fill Your Dc 13 Hawaii Template

The process for officially dissolving a corporation in Hawaii is encapsulated within the DC-13 form, a document critical for businesses concluding their affairs in the state. Through this form, the Department of Commerce and Consumer Affairs mandates a series of steps and information that ensure the dissolution process is handled with legal precision, reflecting the gravity of winding down a corporation. The DC-13 form, updated in July 2011, is structured to capture essential details about the dissolution, including the corporation's name, the authorization date of the dissolution, and the manner in which the decision to dissolve was reached, whether through a shareholder meeting or unanimous written consent. Importantly, the form underscores the need for a resolution of dissolution, specifying voting requirements that have evolved over time. Additionally, it sets a clear framework for determining the dissolution's effective date, providing options for immediate or slightly delayed effectiveness but not exceeding a 30-day window from the filing. The filing process eschews personal and business checks, instead requiring payment through more secure methods, reflecting the seriousness and finality of the dissolution action. This document and its accompanying instructions articulate the procedural and financial responsibilities involved, offering a guide for corporations to conclude their business in Hawaii responsibly and legally.

Document Example

WWW.BUSINESSREGISTRATIONS.COM Nonrefundable Filing Fee $25.00

FORM

No personal or business checks accepted.

Payment of the filing fee should be ONLY in the form of CASH, CERTIFIED/CASHIER'S CHECK,

BANK/POSTAL MONEY ORDER OR CREDIT CARD (VISA OR MasterCard).

Make check or money order payable to DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS. Dishonored Check Fee $25.00.

WWW.BUSINESSREGISTRATIONS.COM Nonrefundable Filing Fee $25.00

No personal or business checks accepted. See instructions.

STATE OF HAWAII

DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS

Business Registration Division

335 Merchant Street

Mailing Address: P.O. Box 40, Honolulu, Hawaii 96810

Phone No.

FORM

*DC13*

ARTICLES OF DISSOLUTION

(Section

PLEASE TYPE OR PRINT LEGIBLY IN BLACK INK

The undersigned, duly authorized officer of the corporation submitting these Articles of Dissolution, certifies as follows:

1.The name of the corporation is:

2.The date the dissolution was authorized:

3.The resolution approving the dissolution was adoption (check one):

at a meeting of the shareholders:

at a meeting of the shareholders:

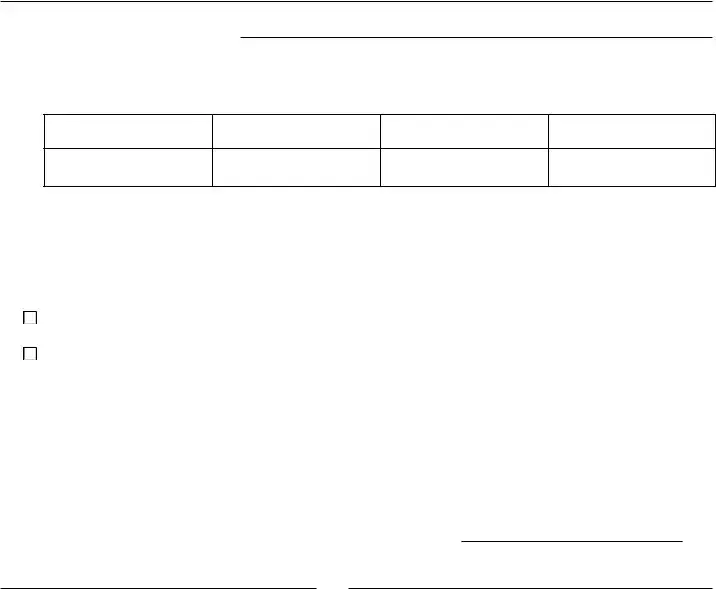

Stock Class/Series

Total Number of Shares

Entitled to be Cast

Number of Shares Cast For

Dissolution

Number of Shares Cast

Against Dissolution

OR

by unanimous written consent of the shareholders.

by unanimous written consent of the shareholders.

4.The dissolution is effective on the date of filing these Articles of Dissolution or on a later date and time, not more than 30 days after the filing, if so stated. The effective date cannot be before the date of filing. Dissolution is effective (check one):

on the date of filing of these Articles of Dissolution; |

|

OR |

|||

on |

|

at |

|

, which is not more than 30 days after |

|

|

|

|

|

|

|

|

(Month Day |

Year) |

|

(Time) |

|

the filing of these Articles of Dissolution.

The undersigned certifies under the penalties of Section

Signed this |

|

day of |

, |

|

|

|

|

|

|

(Type/Print Name & Title) |

(Signature of Officer) |

SEE INSTRUCTIONS ON REVERSE SIDE. The statement must be signed by at least one officer of the corporation.

FORM

Instructions: Articles of Dissolution must be typewritten or printed in black ink, and must be legible. The articles must be signed by at least one officer of the corporation. Signature must be in black ink. Submit articles together with the appropriate fee.

Line 1. State the full name of the corporation.

Line 2. State the date the dissolution was authorized.

Line 3. Check whether the resolution to dissolve the corporation was adopted at a meeting of the shareholders or by unanimous written consent of the shareholders.

For corporations incorporated prior to July 1, 1987:

The resolution must be approved by the affirmative vote of the holders of

For corporations incorporated on or after July 1, 1987:

The resolution must be approved by the affirmative vote of the majority of the holders of shares having voting power. If the resolution was approved by written consent, the vote must be by all of the shareholders.

Check the 1st box if the resolution to dissolve the corporation was adopted at a meeting and complete the four boxes.

Check the 2nd box of the resolution was adopted by written consent of all the shareholders in lieu of a meeting.

Line 4. Check whether the dissolution is effective on the date and time of filing the Articles if Dissolution with the Department of Commerce and Consumer Affairs, State of Hawaii, or whether the dissolution is effective on a future date. If a future date is selected, state the effective date and time which cannot be more than 30 days after the filing of the Articles of Dissolution.

Filing Fees: Filing fee ($25.00) is not refundable. No personal or business checks accepted. Payment of the filing fee should be ONLY in the form of CASH, CERTIFIED/CASHIER'S CHECK, BANK/POSTAL MONEY ORDER OR CREDIT CARD (VISA OR MasterCard). Make check or money order payable to DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS. Dishonored Check Fee $25.00.

For any questions call

Fax

NOTICE: THIS MATERIAL CAN BE MADE AVAILABLE FOR INDIVIDUALS WITH SPECIAL NEEDS. PLEASE CALL THE DIVISION SECRETARY, BUSINESS REGISTRATION DIVISION, DCCA, AT

ALL BUSINESS REGISTRATION FILINGS ARE OPEN TO PUBLIC INSPECTION. (SECTION

Document Characteristics

| Fact | Description |

|---|---|

| Governing Law | Articles of Dissolution are governed by Section 414-383 of the Hawaii Revised Statutes. |

| Filing Fee | The nonrefundable filing fee is $25.00. |

| Payment Methods | Acceptable forms of payment include CASH, CERTIFIED/CASHIER'S CHECK, BANK/POSTAL MONEY ORDER OR CREDIT CARD (VISA or MasterCard). |

| Check Payable To | Make checks or money orders payable to the DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS. |

| Address | The mailing address for form submission is P.O. Box 40, Honolulu, Hawaii 96810. |

| Effective Date of Dissolution | Dissolution can be effective on the date of filing or on a future date not more than 30 days after filing. The effective date cannot be before the date of filing. |

| Signature Requirement | The form must be signed by at least one officer of the corporation in black ink. |

Guidelines on Utilizing Dc 13 Hawaii

After deciding to dissolve a corporation registered in Hawaii, the next step involves filing the necessary paperwork with the Department of Commerce and Consumer Affairs. Specifically, the DC-13 form must be filled out. This document formalizes the process of dissolution in the eyes of the state. It's crucial to pay attention to detail when completing this form to ensure a smooth dissolution process.

To complete the DC-13 form accurately, follow these steps:

- Obtain the form from the website www.businessregistrations.com or the Department of Commerce and Consumer Affairs.

- Ensure all information is typed or printed legibly in black ink.

- In line 1, state the full name of the corporation as it is registered.

- For line 2, fill in the date when the dissolution was officially authorized by the corporation.

- Determine how the resolution to dissolve was adopted:

- If it was at a meeting of the shareholders, check the corresponding box and fill in the details regarding stock class/series, total number of shares entitled to vote, number of shares that voted for the dissolution, and number of shares that voted against it.

- If the dissolution was approved by unanimous written consent of the shareholders, check the related box without the need to fill in the details concerning shares.

- In line 4, indicate when the dissolution will become effective. You can either have it effective upon filing the form or specify a later date and time, not more than 30 days post-filing. Make sure to check the appropriate box and fill in the date and time if opting for a future effectiveness.

- The form must be signed by at least one authorized officer of the corporation. Include the date of signing, and type or print the name and title of the officer next to the signature.

- Prepare the nonrefundable filing fee of $25.00, remembering that payment is accepted only in specific forms: cash, certified/cashier's check, bank/postal money order, or credit card (VISA or MasterCard). Personal or business checks are not accepted.

- Review all information for accuracy and legibility.

- Submit the completed form along with the filing fee to the Department of Commerce and Consumer Affairs at the provided address or through any other specified submission method.

Upon the successful submission of the DC-13 form and the associated fee, the dissolution process enters the review phase by the Department of Commerce and Consumer Affairs. It’s imperative to keep a copy of the submitted materials for your records. Regulatory approval will formalize the dissolution, after which the corporation will legally cease to exist under Hawaii law.

Understanding Dc 13 Hawaii

What is Form DC-13 in Hawaii?

Form DC-13 is the Articles of Dissolution document used by corporations in Hawaii to legally dissolve their business with the State's Department of Commerce and Consumer Affairs (DCCA). This form signifies that a corporation has decided to terminate its existence and outlines the steps taken to authorize the dissolution.

How is the dissolution resolution passed?

The dissolution resolution can be passed in one of two ways: either at a meeting of the shareholders, with the resolution details such as the class/series and number of shares being documented; or, by unanimous written consent of the shareholders in lieu of a meeting. The requirement for the resolution's passage depends on whether the corporation was incorporated before or after July 1, 1987.

What are the filing fees and payment methods for submitting Form DC-13?

The nonrefundable filing fee for Form DC-13 is $25.00. Payment must be made using cash, a certified/cashier's check, a bank/postal money order, or a credit card (VISA or MasterCard only). Personal or business checks are not accepted, and a dishonored check fee of $25.00 will be charged if applicable.

Can the dissolution be effective on a future date?

Yes, the dissolution can become effective on the date of filing these Articles of Dissolution or on a specific future date, as long as it is not more than 30 days after the filing. This allows corporations some flexibility to determine when they officially cease to exist.

Who must sign Form DC-13?

The form must be signed by at least one officer of the corporation. This signature attests that the officer is authorized to act on behalf of the corporation and that the information provided in the form is accurate.

How can someone get assistance or additional information about Form DC-13?

For questions or additional information about Form DC-13, you can contact the Hawaii Department of Commerce and Consumer Affairs' Business Registration Division at (808) 586-2727. For those on neighboring islands, specific phone numbers are provided in the form's instructions, and there's also a toll-free number available. Additionally, contact can be made via fax or email, as provided in the form's instructions.

Common mistakes

When filling out the DC-13 form for the State of Hawaii, individuals often encounter pitfalls that can hinder the process. Paying attention to detail when completing this form is crucial, as errors can lead to delays or the rejection of the dissolution filing. Below is a list of five common mistakes to avoid:

-

Incorrect Payment Method: One of the major hurdles involves the form of payment. Since personal or business checks are not accepted, the filing fee of $25.00 must be provided using only approved mediums: cash, certified/cashier's check, bank/postal money order, or by using a VISA or MasterCard credit card. Overlooking this detail can cause immediate rejection of the form.

-

Not Using Black Ink for Printed or Typed Information: The instructions clearly state that the form must be filled out legibly in black ink. Any submissions made in other ink colors risk not being processed, leading to unnecessary delays.

-

Failing to Choose the Correct Dissolution Method: The form requires specifying whether the dissolution was approved at a shareholder meeting or through unanimous written consent in lieu of a meeting. Mistakenly selecting the wrong option or neglecting to complete this section accurately compromises the form’s validity.

-

Leaving the Effective Date of Dissolution Blank or Incorrectly Stated: The dissolution can either be effective upon the date of filing or on a future date, not exceeding 30 days after filing. Specifying an incorrect effective date, or failing to provide one that adheres to this criterion, can invalidate the filing.

-

Incorrect or Missing Signature: The form must be signed by at least one officer of the corporation in black ink. Overlooking the signature section or using a different ink color can result in the need to resubmit the form, further delaying the dissolution process.

Avoiding these common mistakes when completing the DC-13 form ensures a smoother process for dissolving a corporation in Hawaii. With careful attention to the specific requirements outlined for the submission, individuals can expedite their filing and avoid unnecessary setbacks.

Documents used along the form

When dissolving a corporation in Hawaii, the Form DC-13, also known as the Articles of Dissolution, is a critical document. However, completing the dissolution process often requires several other forms and documents to fully comply with state laws and regulations. Here is a list of some documents that are frequently used alongside the Form DC-13.

- Form DC-15: Statement of the Dissolution Decision - This document provides a record of the decision to dissolve the corporation, detailing the vote or agreement by the shareholders or board of directors.

- Form P-5: Application for Tax Clearance - Before a corporation can be formally dissolved, it must settle any outstanding taxes with the Hawaii Department of Taxation. This form is used to apply for a tax clearance certificate, showing all taxes have been paid or arrangements have been made to pay them.

- Form X-3:: Certificate of Election to Dissolve - For corporations choosing to dissolve voluntarily and before commencing the dissolution process, this form records the election to dissolve and the manner in which the decision was made.

- Form A-6: Tax Clearance Application - Similar to the P-5, this form is specifically for obtaining a tax clearance from the Department of Taxation, but it's designed for entities other than corporations, such as partnerships or LLCs that may be related to the corporation.

- Notice of Dissolution: Public Announcement - While not a standardized form, corporations are often required to publish a notice of dissolution in a local newspaper. This serves as a public announcement to creditors and other interested parties that the corporation is dissolving.

Together, these documents complement the dissolution process initiated by the Form DC-13, guiding the corporation through the requirements to ensure legal and financial responsibilities are met. Seeking the right guidance and using all pertinent forms according to the state of Hawaii's regulations will lead to a smooth dissolution process.

Similar forms

The DC-13 Hawaii form, essential for corporations seeking to dissolve officially in the state of Hawaii, echoes the structure and purpose of several other types of legal documents related to corporate procedures. Among these, the Articles of Incorporation and the Statement of Information stand out for their foundational roles in a corporation's lifecycle, from creation to dissolution, maintaining a cohesive legal framework that governs corporate activities.

Similar to the DC-13 form, Articles of Incorporation serve as a critical document for corporations. This document establishes a corporation's existence under state law. Like the DC-13, which formalizes the dissolution process, the Articles of Incorporation are vital for laying the groundwork, specifying the corporation's name, purpose, stock details, and the identities of its initial directors. Both documents require filing with the state’s Department of Commerce and Consumer Affairs (or an equivalent entity), making them official records that signal the beginning and end of a corporation's lifecycle.

Another document akin to the DC-13 form is the Statement of Information. This filing, usually required on an annual or biennial basis, updates a state on a corporation’s operational details, including address changes, current directors, and service of process agent. Though it serves more as an update than a foundational or concluding document, its necessity for maintaining good standing parallels the DC-13’s role in officially closing a corporation's chapter. Both documents ensure that the corporation's status is accurately reflected in public and government records, facilitating transparency and compliance.

Dos and Don'ts

When filling out the DC-13 form for the State of Hawaii, it is essential to follow certain do's and don'ts to ensure the process goes smoothly and without error. This guidance will help you complete the form correctly and avoid common mistakes.

Do's:- Use black ink: When filling out the form, either type or print legibly in black ink to ensure the information is clear and readable.

- Check the payment method: Remember, personal or business checks are not accepted. Make sure your payment for the filing fee is in the form of cash, certified/cashier's check, bank/postal money order, or by credit card (VISA or MasterCard).

- Verify the information: Before submitting the form, double-check that all information provided is accurate and complete. This includes the corporation’s full name, the date the dissolution was authorized, and the effective date of the dissolution.

- Sign the form: Ensure that at least one officer of the corporation signs the form. The signature must be in black ink.

- Contact for clarification: If there are any questions or something is not clear, don't hesitate to contact the Business Registration Division at the provided phone numbers or email address.

- Avoid using non-approved payment methods: As personal and business checks are not accepted, avoid trying to use them for the filing fee to prevent delays in the processing of your form.

- Don’t forget the nonrefundable fee: Keep in mind that the filing fee is nonrefundable. Make sure you are ready to proceed with the dissolution before submitting the form and the fee.

- Don’t leave sections incomplete: Every section of the form requires attention. Leaving sections incomplete can result in the rejection of the form.

- Don’t overlook special needs: If you require the materials in a different format due to special needs, don’t forget to make a request by contacting the Division Secretary.

By following these guidelines, you can ensure that the process of completing and submitting the DC-13 form for your business dissolution in Hawaii is as smooth and error-free as possible.

Misconceptions

When it comes to handling the dissolve a corporation in Hawaii, the DC-13 Form is a crucial document. However, there are several misconceptions about this form that need to be cleared up:

- Misconception 1: Personal or Business Checks Are Accepted for the Filing Fee

- Misconception 2: The Filing Fee Is Refundable.

- Misconception 3: Any Officer Can Sign the Form

- Misconception 4: The Effective Date of Dissolution Can Be Any Time

This is incorrect. The form clearly specifies that no personal or business checks will be accepted. The filing fee, which is nonrefundable, must be paid by cash, certified/cashier’s check, bank/postal money order, or by using a VISA or MasterCard credit card. This specific instruction is designed to streamline the payment process and ensure funds are immediately available.

Some might think that if their filing for dissolution is rejected or they change their mind, the fee they paid is refundable. However, the form clearly states that the $25.00 filing fee is nonrefundable, meaning once paid, it cannot be returned regardless of the dissolution's outcome or if the process is halted by the corporation.

While it might seem like any member of the corporation can sign off on the Articles of Dissolution, the form requires that it must be signed by at least one officer of the corporation. This requirement ensures that the dissolution process is being handled by someone with authorized capacity to act on behalf of the corporation.

There is a belief that the corporation can choose any date in the past or far in the future as the effective date of dissolution. However, the form specifies that the effective date of dissolution is either on the date of filing these Articles of Dissolution with the Department of Commerce and Consumer Affairs or on a later date if stated, but it cannot be more than 30 days after the filing and cannot precede the filing date. This rule aims to provide a clear and legal timeframe for the dissolution process.

Understanding these key points helps ensure that the process of dissolving a corporation in Hawaii goes smoothly and according to the state’s legal requirements.

Key takeaways

When preparing and submitting the DC-13 form for dissolving a corporation in Hawaii, it is essential to adhere to the following key takeaways:

- The nonrefundable filing fee for the form is $25.00. Ensure you have arranged this payment accurately, as personal or business checks are not accepted.

- Payments must be made in the form of CASH, CERTIFIED/CASHIER'S CHECK, BANK/POSTAL MONEY ORDER, or CREDIT CARD (VISA or MasterCard).

- The form needs to be filled out legibly, using black ink for printing or typing, which helps in avoiding any processing delays due to illegibility.

- It is necessary for at least one officer of the corporation to sign the form, thereby certifying the dissolution. The signature should also be in black ink.

- Clearly indicate the effective date of dissolution on the form. The dissolution can be effective on the date of filing or on a specific future date, provided it is not more than 30 days after filing.

- For resolutions adopted at shareholders' meetings or through unanimous written consent, the form requires specific information pertaining to the class or series of stock, number of shares entitled to cast, votes for and against the dissolution.

- Be aware of the voting requirements that differ based on the corporation's incorporation date. Corporations incorporated before July 1, 1987, and those incorporated on or after this date have different criteria for the affirmative vote required for the adoption of the dissolution resolution.

- If assistance is needed, or if individuals with special needs require accommodations to access the form, the Department of Commerce and Consumer Affairs (DCCA) provides contact information for inquiries and support.

Remember, all business registration filings, including the Articles of Dissolution, are open to public inspection as per Section 92F-11, Hawaii Revised Statutes (HRS). Thus, it's crucial to ensure that all submitted information is accurate and complete.

Create Common PDFs

Hawaii Sa 1 - It includes sections for activity details, transportation mode, costs, and medical insurance coverage.

Uh Manoa Gpa Requirements - Acts as a historical record for employee appointments, modifications, and terminations.

N-15 - A clear declaration section is included for the preparer to attest to the accuracy and truthfulness of the submitted information.