Fill Your Hawaii Llc 3 Template

For entrepreneurs looking to establish a Limited Liability Company (LLC) in Hawaii, navigating the paperwork is a crucial step. Among the forms required, the Hawaii LLC-3 Form stands out as a significant document. This form, essential for registering an LLC within the state, encompasses several key areas. It gathers information about the business, such as the name of the LLC, its purpose, the principal office address, the name and address of the registered agent, and the names of the members or managers. Furthermore, it asks for details regarding the duration of the LLC, whether it will be managed by members or managers, and the organizer's contact information. Completing this form accurately is crucial, as it lays the groundwork for your business's legal identity in Hawaii, ensuring compliance with state regulations and facilitating the smooth operation of the LLC. Understanding each section's requirements can help in avoiding delays or issues with the state's Department of Commerce and Consumer Affairs, which is responsible for processing these forms.

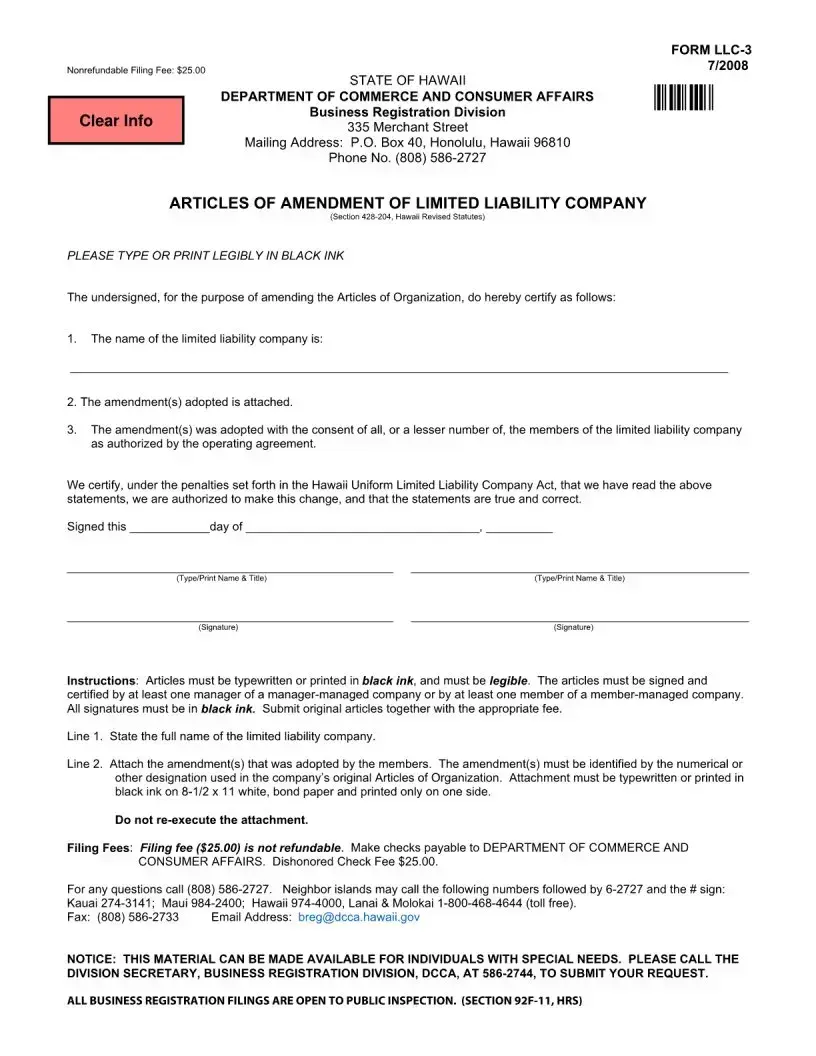

Document Example

Document Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Hawaii LLC-3 form is used for the Articles of Organization, which are required to officially form a limited liability company (LLC) in the state of Hawaii. |

| Required by Law | This form is mandated by Hawaii Revised Statutes Section 428-203, which specifies the necessary process and information for establishing an LLC in Hawaii. |

| Filing Process | Applicants must submit the form to the Hawaii Department of Commerce and Consumer Affairs, Business Registration Division, either online or by mail. |

| Filing Fee | A non-refundable fee is required with the submission of the form. The exact amount can vary, so it is essential to check the current fee schedule provided by the Department of Commerce and Consumer Affairs. |

| Processing Time | The processing time for the Hawaii LLC-3 form can vary depending on the method of filing and current demand. Online submissions may be processed more quickly than paper submissions. |

Guidelines on Utilizing Hawaii Llc 3

After deciding to establish a Limited Liability Company (LLC) in Hawaii, completing the Form LLC-3, also known as the "Articles of Organization," is a critical step. This document is essential for legally registering your business with the state. The form requires specific information about your LLC, including its name, purpose, and the details of its registered agent, among others. Ensuring accuracy and completeness in this process is paramount, as it establishes the foundation of your business under state law. The following steps are designed to guide you through each section of the form smoothly and effectively.

- Enter the name of the LLC exactly as you wish it to appear on official documents, including the designator "LLC" or "L.L.C." at the end to signify its status as a limited liability company.

- Specify the purpose for which the LLC is being formed. This should be a brief statement outlining the business activities or services the company intends to provide.

- Provide the mailing address for the LLC's principal office. This includes the street address, city, state, and zip code where the main business operations will be conducted.

- List the name and physical address of the LLC's initial registered agent in Hawaii. This agent is responsible for receiving legal documents on behalf of the company. The address must be within the state and cannot be a P.O. Box.

- If applicable, include the duration of the LLC by stating a specific dissolution date. If the LLC is intended to exist perpetually, this can be left blank or stated as "perpetual."

- Specify whether the LLC will be managed by members or managers. Tick the appropriate box to indicate the management structure. If managed by managers, include the names and addresses of the initial managers.

- Provide the name(s) and address(es) of each organizer of the LLC. An organizer is someone involved in the setup of the LLC, but doesn't need to be a member or manager.

- For LLCs opting to have a specific effective date different from the filing date, enter the desired date on which the Articles of Organization should officially come into effect.

- Sign and date the form. The organizer(s) must sign the form, indicating their role in creating the LLC and affirming the accuracy of the information provided.

Following the completion of these steps, the Form LLC-3 should be reviewed for accuracy and completeness. It's important to adhere to the specific filing instructions provided by the state of Hawaii, including payment of any necessary filing fees. Once the form and fees are submitted, the state will process the application and, upon approval, officially register your LLC. This marks a significant step in the journey of establishing and formalizing your business presence in Hawaii.

Understanding Hawaii Llc 3

-

What is the Hawaii LLC-3 form?

The Hawaii LLC-3 form, officially known as the "Articles of Organization," is a legal document required for the establishment of a Limited Liability Company (LLC) in the state of Hawaii. It outlines essential information about the LLC, including its name, purpose, mailing address, and the details of its registered agent. This document must be filed with the Hawaii Department of Commerce and Consumer Affairs to legally operate as an LLC in Hawaii.

-

Who needs to file the Hawaii LLC-3 form?

Any individual or group of individuals who wish to form an LLC in the state of Hawaii must file the LLC-3 form. This applies to residents of Hawaii planning to start a business in the state, as well as out-of-state parties interested in establishing a business presence in Hawaii.

-

How can one file the Hawaii LLC-3 form?

There are two primary methods for filing the Hawaii LLC-3 form: online through the Hawaii Business Express website, or by mailing a printed copy to the Business Registration Division of the Hawaii Department of Commerce and Consumer Affairs. Filing online is typically faster and allows for immediate confirmation of submission and payment. Mailed applications may take longer to process.

-

What is the filing fee for the Hawaii LLC-3 form?

The filing fee for the Hawaii LLC-3 form is subject to change, so it is advised to consult the most recent fee schedule provided by the Hawaii Department of Commerce and Consumer Affairs. As of the last update, the filing fee was $50. Additional fees may apply for expedited processing or other supplementary services.

-

What information is required on the Hawaii LLC-3 form?

The following pieces of information must be included on the Hawaii LLC-3 form:

- The name of the LLC, which must comply with Hawaii's naming requirements.

- The purpose for which the LLC is formed, which can be a specific purpose or a general purpose statement.

- The mailing address of the LLC's principal place of business.

- The name and address of the LLC's initial registered agent in Hawaii.

- A statement indicating whether the LLC will be managed by its members or by a manager or managers.

-

Can the Hawaii LLC-3 form be filed without a registered agent?

No, the Hawaii LLC-3 form cannot be successfully filed without naming a registered agent. The registered agent acts as the LLC's official contact for legal documents and must have a physical address (not a P.O. Box) in Hawaii. The agent can be an individual resident of Hawaii or a business entity authorized to do business in Hawaii.

-

What happens after the Hawaii LLC-3 form is filed?

Once the LLC-3 form is processed and approved by the Hawaii Department of Commerce and Consumer Affairs, the LLC will be officially registered and authorized to conduct business in Hawaii. The LLC will receive a certificate of organization, which is proof of the legal status of the LLC. This certificate is necessary for various business activities, including opening a bank account.

-

Is there ongoing compliance for an LLC in Hawaii after the LLC-3 form is filed?

Yes, after the LLC-3 form is filed, there are ongoing compliance requirements for an LLC in Hawaii. These include filing annual reports and maintaining a valid registered agent. The LLC must also ensure that its business activities adhere to Hawaiian law and regulations relevant to its industry.

-

Can an LLC be formed for any type of business in Hawaii?

Yes, an LLC can be formed for almost any type of business in Hawaii. However, some regulated professions and activities may have additional requirements or may not be permitted to form an LLC. It is advisable to consult with a legal advisor to ensure that your business activity is compliant with state laws and regulations before proceeding with the formation of an LLC.

-

How long does it take to process the Hawaii LLC-3 form?

The processing time for the Hawaii LLC-3 form can vary based on the method of submission and current processing volumes at the Department of Commerce and Consumer Affairs. Online submissions may be processed more quickly, often within business days, while mailed submissions can take several weeks. It's advisable to check the current processing times and consider expedited options if necessary.

Common mistakes

-

Not providing the complete legal name of the LLC. The name must match exactly what is registered with the State of Hawaii, including any designators like "LLC" or "L.L.C."

-

Omitting the purpose of the LLC. While some may think it's not crucial, this section must be filled out clearly to inform the state of the primary activities of your business.

-

Skipping the registered agent information. Every LLC in Hawaii must have a registered agent with a physical address in the state (P.O. boxes are not acceptable), responsible for accepting legal documents on behalf of the LLC.

-

Incorrectly calculating fees. The filing fee depends on several factors and must be accurately calculated to avoid delays. Double-check the current fee structure on the State of Hawaii's website before submitting.

-

Misunderstanding member versus manager management. An LLC can be managed by its members (owners) or designated managers. This choice affects the company's operating agreement and how decisions are made, so it's important to select the correct option for your business.

-

Forgetting to attach necessary documents. Depending on your LLC's specific circumstances, additional documents may be required. This could include articles of organization amendments or operating agreements.

-

Ignoring the necessity for an Operating Agreement. Though not filed with the Hawaii LLC-3 form, an Operating Agreement is crucial for outlining the operational and financial relationships among the owners. Not having one can lead to disputes or legal issues down the line.

Filling out the Hawaii LLC-3 form with care and due diligence can save time and resources. Avoiding these common mistakes can help ensure a smoother registration process and set a solid foundation for your business.

Documents used along the form

When forming or managing a Limited Liability Company (LLC) in Hawaii, various documents and forms are needed beyond the initial registration. These supplementary documents are essential for compliance, governance, financial management, and other critical business operations. Without them, an LLC may face legal hurdles, operational inefficiencies, or even penalties. Thus, understanding these documents is fundamental for business owners and members.

- Articles of Organization: This foundational document formally establishes the LLC with the state of Hawaii. It includes critical information such as the LLC's name, purpose, office address, and the names of its members and organizers.

- Operating Agreement: Although not filed with the state, this internal document outlines the governance structure of the LLC, member roles, profit distribution, and protocols for various operational scenarios. It's pivotal in managing internal affairs and resolving disputes.

- Annual Report: Hawai‘i requires LLCs to submit an annual report with current information about the company, such as details about members, managers, and any changes to the business address or operational focus. This maintains the LLC's good standing with the state.

- Change of Registered Agent Form: If an LLC needs to change its registered agent - the individual or company designated to receive legal documents on behalf of the business - this form must be submitted to the state office, ensuring that the LLC remains compliant with state requirements.

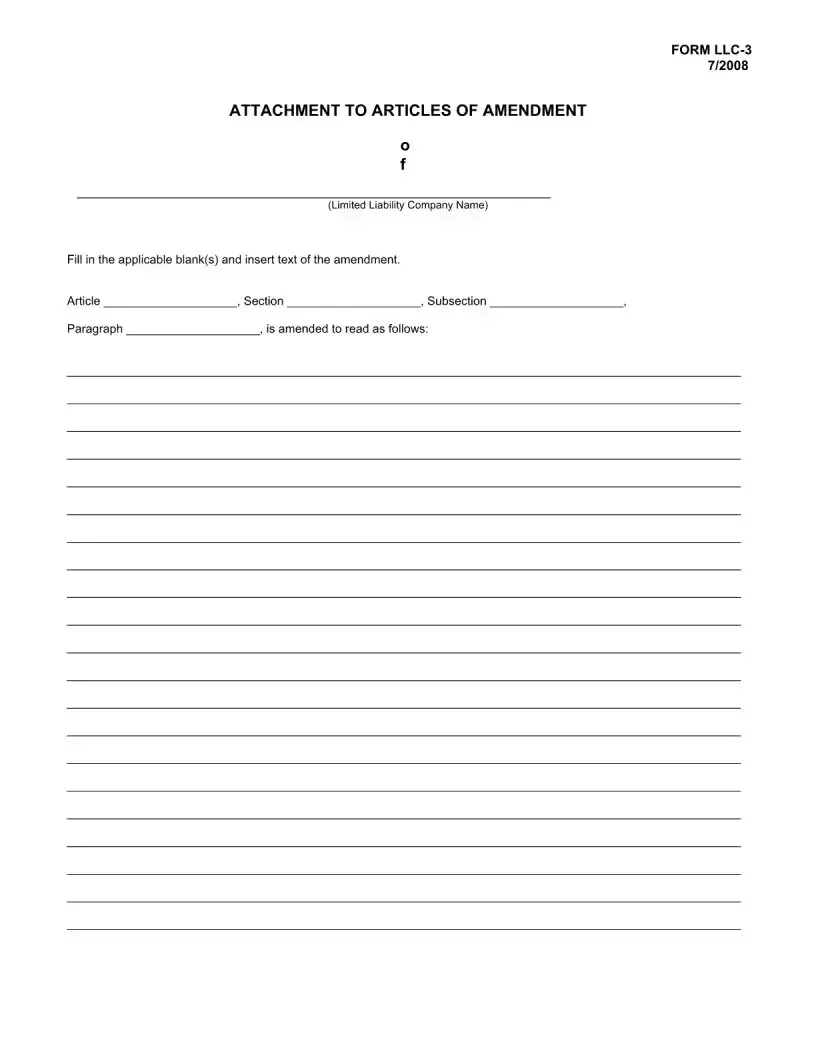

- Articles of Amendment: This document is necessary when significant changes occur within the LLC, such as a name change, alteration in business purpose, or a shift in management structure. Filing this form with the state updates the official records for the LLC.

- Articles of Dissolution: Should there come a time to cease operations, this form officially dissolves the LLC, removing its obligation to pay future taxes and file reports. It's a critical step in responsibly closing a business.

- Application for Tax ID (EIN): Obtaining an Employer Identification Number from the IRS is essential for tax reporting, hiring employees, and opening a business bank account, making it a fundamental step in the business setup process.

Each of these documents plays a unique and crucial role in the lifecycle of an LLC in Hawaii. From formation to dissolution, they ensure that the business meets its legal requirements, maintains its operational capabilities, and supports its growth objectives. Careful attention to these forms and documents can prevent legal and administrative complications, fostering a healthy business environment.

Similar forms

The Hawaii LLC 3 form is similar to several other documents utilized in the business world for organizations looking to establish or maintain their legal structure and compliance. These documents often share a common goal: to provide clear and structured information to state agencies to ensure that the entity meets all legal and regulatory guidelines necessary for operation within the state. Below are detailed comparisons with two such documents.

The first similar document is the Articles of Organization, commonly used across many states for the formation of a Limited Liability Company (LLC). Like the Hawaii LLC 3 form, the Articles of Organization serve as a foundational document required by state law to officially recognize a company as a legitimate business entity. Both documents require basic yet essential information about the company, including the business name, principal address, and the name and address of the registered agent. Additionally, they may both include details about the management structure of the LLC, specifying whether it's managed by members or managers. The primary difference lies in the specificity and requirements that vary from state to state, with the Hawaii LLC 3 form being tailored to the unique guidelines set forth by Hawaiian law.

Another document closely resembling the Hawaii LLC 3 form is the Annual Report required by many states for LLCs. This report, much like the Hawaii LLC 3 form, is essential for keeping the state informed about the company’s current standing and any changes that might have occurred in the company's structure, location, or management. Both documents ensure that the business remains in good standing with the state by providing up-to-date information. The content of an Annual Report and the Hawaii LLC 3 form can overlap significantly, as both may include details regarding the company’s addresses, directors, and registered agents. The key distinction typically involves the frequency and the purpose behind the submissions: while the Hawaii LLC 3 is often filed during specific changes or at the time of formation, the Annual Report is a recurring requirement designed to maintain current records with the state on an annual basis.

Dos and Don'ts

When completing the Hawaii LLC-3 form, it's important to follow best practices to ensure accuracy and compliance with state regulations. Below are lists of things you should and shouldn't do when filling out this form.

What You Should Do:

- Double-check the LLC name for accuracy to ensure it matches the name registered with the Hawaii Department of Commerce and Consumer Affairs.

- Provide a complete and accurate mailing address where the LLC can receive official and legal correspondence.

- Include the LLC's Hawaii Business Registration Number to avoid processing delays.

- Clearly state the purpose of the LLC to ensure it aligns with Hawaii's business operation regulations.

- Sign and date the form to confirm the accuracy and completeness of the information provided.

What You Shouldn't Do:

- Don't leave any sections blank. If a section does not apply, fill in "N/A" to indicate this.

- Avoid using a PO Box as the only address unless you also provide a physical street address for the principal office.

- Don't use nicknames or abbreviations for the LLC name; always use its full, legal name.

- Refrain from submitting the form without double-checking for errors or missing information.

- Do not forget to include the necessary filing fee, as failing to do so will delay processing.

Misconceptions

When it comes to understanding the Hawaii LLC-3 form, a number of misconceptions can lead to confusion or errors in the registration process. Here is a straightforward breakdown to clarify some of these common misunderstandings:

The form is only for new businesses. Contrary to this belief, the Hawaii LLC-3 form is also utilized by existing companies that need to amend their original LLC filings. Amendments might include changes in the company address, change of managers, or the addition of new members.

Any changes require a new LLC-3 form. While the LLC-3 form is essential for amendments, not every change within an LLC necessitates its submission. Certain minor changes can be communicated directly to the business registration division without needing to fill out this form.

Completing the form guarantees approval. Submission of the LLC-3 form is a step in the process, but it does not assure acceptance of the amendments by the Hawaii Department of Commerce and Consumer Affairs. The review process may identify issues that need to be corrected before approval.

The form can be filed anytime. While it might seem that the form can be submitted at any convenience, there are specific deadlines for filing amendments to ensure that the public records are up to date. Failing to meet these deadlines can result in penalties or fines for the LLC.

E-signatures are not accepted. Many assume that a physical signature is required on the LLC-3 form. However, Hawaii's Department of Commerce and Consumer Affairs does accept electronic signatures on this form, streamlining the filing process.

There is no fee for filing the form. Actually, there is a filing fee associated with the LLC-3 form. The amount can vary, so it's important for filers to check the latest fee schedule on the Hawaii DCCA website to ensure the correct amount is submitted with their amendments.

Legal assistance is required to complete the form. While it can be beneficial to consult with a legal professional when making significant changes to your LLC, the instructions provided by the Hawaii Department of Commerce and Consumer Affairs are designed to help members or managers of the LLC complete the form without mandatory legal representation. Careful review of the provided instructions can help ensure the form is filled out correctly.

Key takeaways

Filling out and using the Hawaii LLC-3 form requires attention to detail and a thorough understanding of the purpose and requirements of this document. Here are some key takeaways to ensure the process is handled correctly and efficiently.

- Accuracy is crucial: Make sure all information provided on the Hawaii LLC-3 form is accurate and up to date. This includes the legal name of the LLC, the principal office address, the names and addresses of the members or managers, and any other information that is requested on the form. Inaccurate or incomplete information can lead to delays in processing or even the rejection of the form.

- Understand the purpose: The Hawaii LLC-3 form is used for specific changes or updates related to a limited liability company. This may include changes to the company's articles of organization, updates to member or manager information, or amendments to the LLC’s operating agreement. Before filling out the form, it's important to understand exactly what changes it is designed to report or enact to ensure it's the correct document for your needs.

- Follow the filing instructions carefully: Each section of the Hawaii LLC-3 form comes with specific instructions. It’s essential to read and follow these carefully to ensure that the form is filled out correctly. This includes paying any applicable fees, which are necessary for the form to be processed. Make sure to check for the most current filing requirements and fees, as these can change over time.

- Keep a copy for your records: After the Hawaii LLC-3 form has been completed and submitted, it’s important to keep a copy for your own records. This should include any confirmation or receipt of filing provided by the state. Keeping a record of when and how the form was filed, along with a copy of the submitted document, can be invaluable in the event of any future questions or issues regarding the update or change that was reported.

Create Common PDFs

Hawaii N-15 - Ensures compliance with state tax laws through meticulously outlined sections for credits, adjustments, and deductions.

N-11 Hawaii - A form designed for property sellers in Hawaii to declare they're exempt from tax withholding on real estate sales.

Hawaii Unemployment Frequently Asked Questions - Necessary documentation for unemployment insurance participants to prove active engagement in job seeking.