Fill Your Hawaii N 335 Template

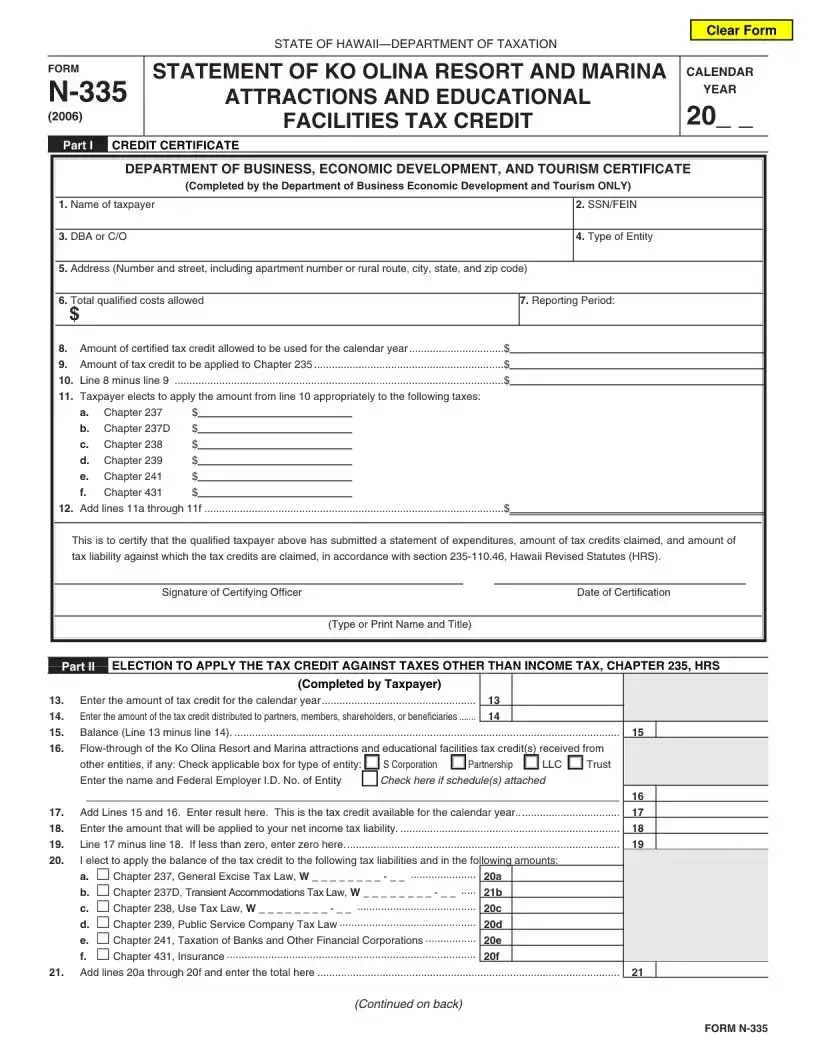

Navigating the legal landscape of Hawaii can often feel like traversing through a lush, intricate maze, where each turn uncovers new regulations and procedures. At the heart of this legal jungle, for many, is the Hawaii N-335 form, a crucial document for those involved in specific taxable scenarios within the Aloha State. This form encompasses a broad range of activities, serving as a comprehensive tool for individuals and entities to report and compute their income accurately. Far from being just another piece of bureaucratic paperwork, the N-335 form embodies the state's commitment to maintaining a fair and balanced taxation system. It meticulously outlines the requisite information needed by the tax department to assess an entity's tax liabilities correctly. Understanding each section of this form is imperative for taxpayers seeking to comply with Hawaii's tax laws fully, ensuring they can navigate the complexities of the system with confidence and accuracy. With detailed instructions and specific fields tailored to different income types, the N-335 form plays a pivotal role in the financial operations of businesses and individuals alike, highlighting the significance of proper tax practices in sustaining the state's economic growth and development.

Document Example

Document Characteristics

| Fact Number | Detail |

|---|---|

| 1 | The Hawaii N-335 form is specific to the State of Hawaii. |

| 2 | It is used primarily for the certification of capital goods excise tax credit. |

| 3 | Governing law for the form includes Hawaii Revised Statutes (HRS) Chapter 235, specifically addressing tax credits. |

| 4 | Eligibility for the credit requires compliance with specific investment criteria in capital goods. |

| 5 | The form is utilized by businesses operating within Hawaii. |

| 6 | Submission of the Hawaii N-335 form is subject to annual deadlines, requiring attention to filing dates. |

| 7 | It allows for the detailing of capital expenditures that qualify for the tax credit. |

| 8 | Correct completion of the form is essential for the approval of the tax credit. |

| 9 | The Hawaii Department of Taxation is the authority responsible for processing the form. |

| 10 | An audit process may be initiated by the Department of Taxation to verify the accuracy of claims. |

Guidelines on Utilizing Hawaii N 335

After completing the Hawaii N 335 form, the individual can anticipate a calculation process that involves assessment and validation of the data provided. This step is crucial, ensuring that one meets the eligibility and requirements laid out by the document. It's not just about filling out the form; it’s about ensuring accuracy and compliance with Hawaiian state laws. The steps to fill out the form are outlined below to facilitate a smooth process for the person.

- Locate the form on the official website or through a local government office to ensure you have the most current version.

- Start by entering your personal information, including your full legal name, address, and contact details in the designated fields at the top of the form.

- Proceed to fill out the financial details requested. This will include information regarding income, deductions, and any credits you are claiming. Ensure the accuracy of the figures entered to avoid discrepancies.

- In sections requiring detailed descriptions or explanations, make sure to provide concise yet comprehensive information. Use additional sheets if the space provided is insufficient, ensuring they are securely attached to the N 335 form.

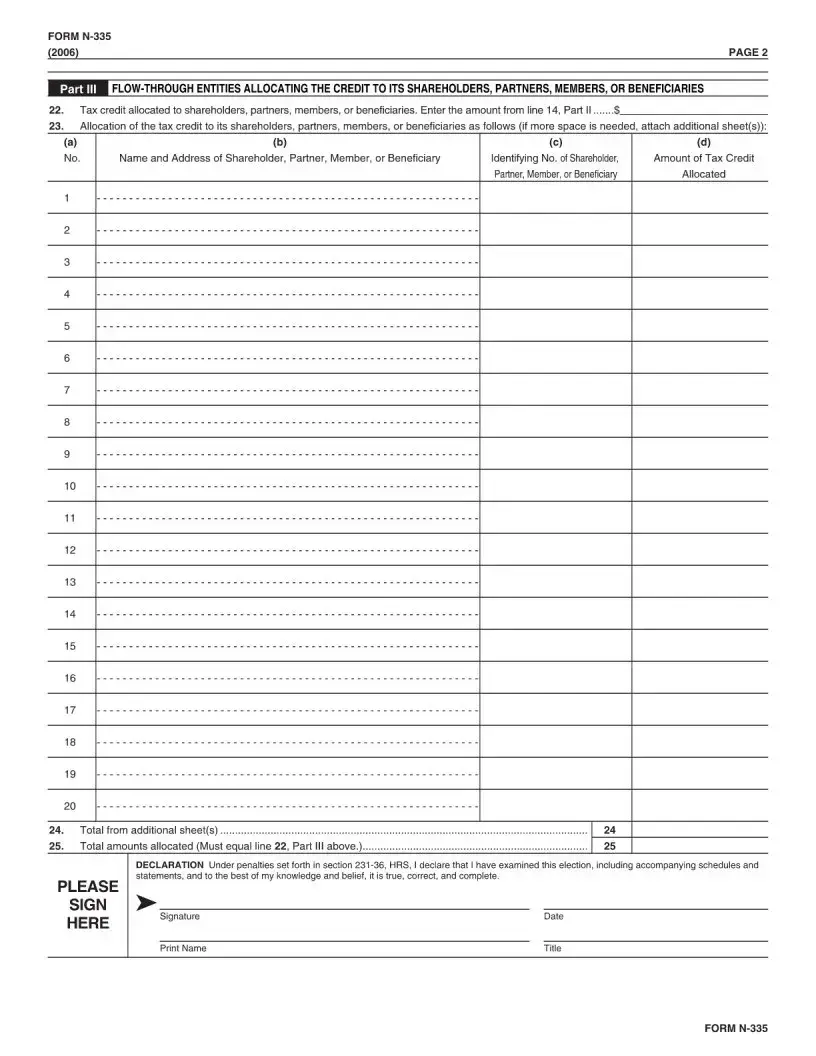

- If the form requires information about dependents or beneficiaries, include their full names, relationships to you, and any other requested details accurately.

- Review the sections that may require supplemental documentation or certifications. Prepare these documents in advance to accompany the form upon submission.

- Sign and date the form in the designated area. Your signature is a confirmation of the accuracy and truthfulness of the information provided. Missing or invalid signatures may result in processing delays.

- Before submitting, recheck the entire form for errors or omissions. Correct any mistakes to ensure the form is complete.

- Follow the specific submission guidelines provided, which may include mailing addresses, electronic submission protocols, or in-person delivery options.

Upon submission, the entity responsible for processing the Hawaii N 335 form will review the document for completeness and accuracy. It's essential to retain a copy of the completed form and any correspondence for your records. Timely and accurate completion of the form helps streamline the processing and avoids unnecessary delays.

Understanding Hawaii N 335

What is the Hawaii N 335 form?

The Hawaii N 335 form, also known as the "High Technology Business Investment Tax Credit" form, is a document used by businesses in Hawaii to apply for a tax credit designed to encourage investment in high technology sectors. This form is a critical tool for businesses seeking to leverage financial incentives for innovation within the state.

Who is eligible to file the Hawaii N 335 form?

Eligibility to file the Hawaii N 335 form is primarily extended to businesses engaged in high-technology activities within Hawaii. These can include research and development, biotechnology, software development, and more. Businesses must meet specific criteria set forth by the state to qualify for the tax credit.

What are the benefits of filing the Hawaii N 335 form?

Filing the Hawaii N 335 form allows eligible businesses to receive a tax credit, which can significantly reduce their state tax liability. This incentive not only supports business growth and development within high-tech industries but also fosters innovation and job creation across the region.

How can a business apply for the tax credit using the Hawaii N 335 form?

To apply for the tax credit using the Hawaii N 335 form, businesses must first ensure they meet the eligibility criteria. Once confirmed, they should accurately complete the form and attach any required documentation, such as financial statements or project descriptions, before submitting it to the Hawaii Department of Taxation. It is recommended to consult with a tax professional to ensure the application is properly prepared.

What information is required to complete the Hawaii N 335 form?

Completing the Hawaii N 335 form requires detailed information about the business applying for the tax credit, including the business name, contact information, description of high-technology activities, investment amounts, and expected benefits of the investment. Specific financial information and documentation supporting the tax credit claim must also be provided.

What is the deadline for filing the Hawaii N 335 form?

The deadline for filing the Hawaii N 335 form typically aligns with the business's tax return filing deadlines. However, deadlines can vary, so it's important to refer to the Hawaii Department of Taxation's guidelines or consult a tax professional to ensure the form is filed on time.

Can the tax credit be carried forward or transferred?

Yes, if the tax credit exceeds the business's tax liability for the year it is claimed, the excess amount may be carried forward to offset future tax liabilities for a specified number of years, according to Hawaii tax laws. The ability to transfer the tax credit to another entity varies, so it's crucial to review current regulations or consult with a tax expert.

Where can a business find more information or assistance with the Hawaii N 335 form?

Businesses seeking more information or assistance with the Hawaii N 335 form can contact the Hawaii Department of Taxation directly or visit its official website. Additionally, consulting with a tax professional who has experience with Hawaii tax laws and credits can provide valuable guidance through the application process.

Are there any common mistakes to avoid when filling out the Hawaii N 335 form?

Common mistakes to avoid include incomplete or inaccurate information, failure to attach required documentation, and missing the filing deadline. Ensuring that all sections of the form are thoroughly and accurately completed, and that all supporting documents are attached, can help avoid delays or denial of the tax credit application.

Common mistakes

-

Not thoroughly reviewing the instructions before starting can lead to misunderstandings about the required information and how it should be presented. Every section of the form has specific requirements, and overlooking these can result in incorrect or incomplete submissions.

-

Entering incorrect personal information, such as misspellings in names or inaccurate Social Security numbers, can cause significant delays in processing. It's critical that individuals double-check these details for accuracy.

-

Failing to attach required supporting documents is another common mistake. These documents verify the information provided on the form and are essential for a successful application process. Omission can result in outright rejection or requests for additional information, prolonging the process.

-

Choosing the wrong status or category that does not accurately reflect the individual’s situation can lead to processing errors. The categories are designed to apply to various circumstances, and selecting the incorrect one can misrepresent an individual's eligibility or need.

-

Forgetting to sign and date the form is a surprisingly frequent oversight. A signature is a legal requirement, certifying the accuracy of the information provided. An unsigned form is often considered incomplete and can be returned to the sender.

-

Attempting to use the form for purposes other than those for which it was intended is a misuse of the document. The Hawaii N 335 form serves specific functions, and trying to repurpose it can create confusion and delay.

To ensure a successful submission, applicants should:

- Read all instructions carefully before beginning.

- Verify all personal information for accuracy.

- Include all required supporting documents with the application.

- Select the correct status or category.

- Remember to sign and date the form.

- Use the form solely for its intended purpose.

Understanding and avoiding these common mistakes can help streamline the process, making it smoother and more efficient for everyone involved.

Documents used along the form

When preparing or dealing with the Hawaii N-335 form, it's often not just about one document. This form, critical in capturing tax credits for renewable energy technologies, marks a step in a broader paperwork journey. Alongside it, several other documents are frequently utilized, each playing its role in ensuring adherence to regulations, eligibility for benefits, or simply for procedural completeness. This complementary paperwork spans from proof of eligibility to detailed submissions of technological specifications.

- Form N-342: Renewable Energy Technologies Income Tax Credit – This form is integral for individuals or corporations that install systems for solar energy, wind energy, or other eligible renewable energy technologies. It provides detailed instructions and fields for claiming tax credits, akin to those detailed in the N-335 form.

- Form N-310: Application for Automatic Extension of Time to File Hawaii Income Tax Return – Often used if more time is needed to gather necessary documents or information before filing tax returns including the N-335. It grants an extension, ensuring filers are not penalized for late submissions of their claims.

- Installation and Certification Report – Required for substantiating the installation of renewable energy technologies. This report provides a verification process for the tax authorities to ensure that the installations comply with state standards and are eligible for the credits claimed on forms like the N-335 and N-342.

- Proof of Payment/Invoices – Essential for verifying the costs incurred in the installation of renewable energy systems. These documents must itemize expenses and are crucial for calculating the tax credits correctly.

- Technical Specifications Sheet – Offers detailed information about the renewable energy system installed, including its capacity, expected output, and efficiency. This document supports claims made on tax credit forms by providing proofs of eligibility and conformity to regulatory standards.

- IRS Form 5695: Residential Energy Credits – Used for federal tax purposes, this form allows individuals to claim renewable energy credits on their federal tax returns. While it serves a different jurisdiction, it is often filed in conjunction with state-specific forms like the N-335 to maximize tax incentives across different levels of government.

- Form G-45: General Excise/Use Tax Return – While not directly related to the installation of renewable energy systems, this form is often pertinent for businesses involved in the sale or lease of such systems within Hawaii. It addresses the tax implications of transactions that might indirectly affect the financial outcomes of installing renewable energy solutions.

- Permit Applications – Depending on the type and scale of the renewable energy system installation, various permits may be required from local or state authorities. These documents ensure that the installation abides by zoning, safety, and environmental regulations, further supporting the legitimacy of claims made on the N-335 and related forms.

Together, these documents form a comprehensive dossier, supporting each step from installation to claiming tax incentives for renewable energy systems. The meticulous compilation of these forms not only reinforces the legitimacy of claims made within the jurisdiction of Hawaii but also ensures that taxpayers maximize their benefits while complying with all regulatory requirements. Hence, anyone involved in this process should approach it with thoroughness, ensuring each document is accurately prepared and duly submitted.

Similar forms

The Hawaii N 335 form is similar to several other documents used across the United States, each serving a unique yet comparable purpose in their respective jurisdictions. While the specifics of the form may vary, the fundamental aspect that binds these documents together is their role in facilitating specific types of requests or notifications within governmental processes.

The California Form 3500 is one such document that shares similarities with Hawaii's N 335 form. Primally, both serve the purpose of exemption requests, though the contexts may differ. The California Form 3500 is used by organizations seeking exemption from state income tax, a process that is intricate and necessitates detailed financial and organizational information. Like the N 335, the California counterpart requires thorough documentation to support the exemption claim, including but not limited to the organization’s founding documents, financial statements, and a detailed description of activities.

New York’s ST-119.1 Form is another document that exhibits parallels to the N 335 form; it is designed for entities seeking a sales tax exemption in New York. Similar to the N 335, applicants must provide comprehensive details pertaining to the organization's mission, operations, and why they qualify for the exemption. Both forms act as a bridge between governmental tax regulations and qualifying organizations, striving to ensure that exemptions are granted to deserving entities based on a stringent review of the information provided.

The Texas Application for Sales and Use Tax Exemption (AP-204), akin to the Hawaii N 335 form, targets organizations seeking exemption from sales and use tax. The detailed application process echoes that of the Hawaii N 335, requiring applicants to furnish extensive documentation detailing the organization's purpose, activities, and financial acumen. Both documents underscore the need for clarity, accuracy, and comprehensive information to prove eligibility for the tax exemption sought.

Dos and Don'ts

When completing the Hawaii N 335 form, it is crucial to approach the task with careful consideration. This document, essential for specific legal or administrative processes in Hawaii, requires accuracy and attention to detail. Below are four practices each to follow and avoid ensuring the form is filled out correctly and effectively.

Do:

- Read through the entire form before starting. This preliminary step ensures that you understand the requirements and have all necessary information on hand.

- Use black ink or type your responses if the option is available. This practice makes the document easier to read and photocopy, and it maintains professionalism.

- Be precise. Providing clear, accurate information helps prevent misunderstandings or delays related to the processing of the form.

- Keep a copy of the completed form for your records. Having a personal copy can be invaluable for future reference or in case there are any discrepancies.

Don't:

- Leave sections blank unless specifically instructed to do so. If a section does not apply, consider entering "N/A" to indicate this clearly.

- Rush through the form. Taking your time can help avoid errors or omissions that might complicate the process.

- Use correction fluid or tape. Mistakes should be neatly crossed out, with the correct information written nearby. This approach maintains the integrity of the document.

Misconceptions

There are several misconceptions about the Hawaii N 335 form that individuals frequently encounter. Understanding these can clarify the form's use and requirements.

Only for Business Use: Many believe that the Hawaii N 335 form is exclusively for businesses. However, it's also applicable for individual taxpayers who need to report certain types of income or financial activities in Hawaii.

Submission Once a Year: The assumption that the Hawaii N 335 form is only filed annually is incorrect. Depending on the specific circumstances, filings may need to occur more frequently, such as quarterly.

Physical Submission Requirement: There's a common misconception that this form must be submitted in paper form. In reality, electronic submission options are available and encouraged for efficiency and environmental concerns.

Complexity for All Users: While the Hawaii N 335 can seem daunting, not all sections may apply to every filer. It's important to read through the instructions carefully to determine which parts of the form are relevant to your situation.

No Support Available: Some believe that help for completing the Hawaii N 335 form is hard to find. Yet, the state of Hawaii provides resources and support for individuals and businesses struggling with the form, including detailed instructions and contact information for assistance.

Key takeaways

The Hawaii N 335 form is crucial for those looking to navigate specific tax-related procedures in the state. Understanding the nuances of correctly filling out and using this form can significantly affect the outcome of your tax-related endeavors. Below are six key takeaways to ensure you approach this form with the necessary knowledge and caution.

- Accuracy is paramount: When completing the Hawaii N 335 form, every detail counts. Ensure that all information is accurate and up to date. Mistakes or inaccuracies can lead to delays or unfavorable outcomes.

- Understand the purpose: The Hawaii N 335 is designed for specific tax situations. It’s important to confirm that this form suits your needs before you begin filling it out. Misapplication can lead to complications with tax filings.

- Pay attention to deadlines: Tax-related forms often have strict deadlines. Submitting the Hawaii N 335 form late can result in penalties or missed opportunities for tax benefits.

- Gather required documentation beforehand: Completing the Hawaii N 335 requires particular documentation. Having all necessary documents at hand before starting can streamline the process.

- Review before submitting: Once the form is filled out, a thorough review is crucial. This step is essential to catch any errors and ensure that all information aligns with supporting documents.

- Seek professional advice if needed: Tax laws and regulations can be complex. If there is any uncertainty about how to proceed with the Hawaii N 335 form, consulting with a tax professional can provide clarity and prevent costly mistakes.

Create Common PDFs

Uh Manoa Gpa Requirements - Assists in updating official employment records with current and accurate employee information.

Cslb Meaning - An official way for companies to communicate to the state who will oversee their construction activities.