Fill Your Hawaii Pts Enrollment Template

Navigating through the intricacies of retirement planning is a crucial step for part-time, temporary, and seasonal or casual employees in Hawaii. The Hawaii PTS Enrollment Form serves as a gateway for these employees to secure their future through the State of Hawaii PTS Deferred Compensation Retirement Plan. Designed to accommodate the unique employment statuses of its users, this form facilitates the process of enrolling in a retirement plan specifically catered to those who might not traditionally qualify for full-time employment benefits. It requires detailed personal and employment information, including the designation of a beneficiary to ensure that employees’ funds are directed according to their wishes in the event of their death. Additionally, the form addresses other employment and clarifies eligibility concerning the State Employees’ Retirement System (ERS), emphasizing the need for accurate information to avoid potential complications with payroll deductions or legal repercussions associated with erroneous submissions. Completing this form and adhering to its stipulations—including a mandatory contribution to Medicare and a 7.5% gross wage deduction towards the retirement plan—is not just a formality; it's a step towards a secure financial future. The plan also accommodates individuals with special needs, in compliance with the Americans with Disabilities Act of 1990, ensuring that all eligible employees have access to this critical resource. The importance of this document cannot be overstated for those it serves, marking an essential point of action in preparing for a financially stable retirement.

Document Example

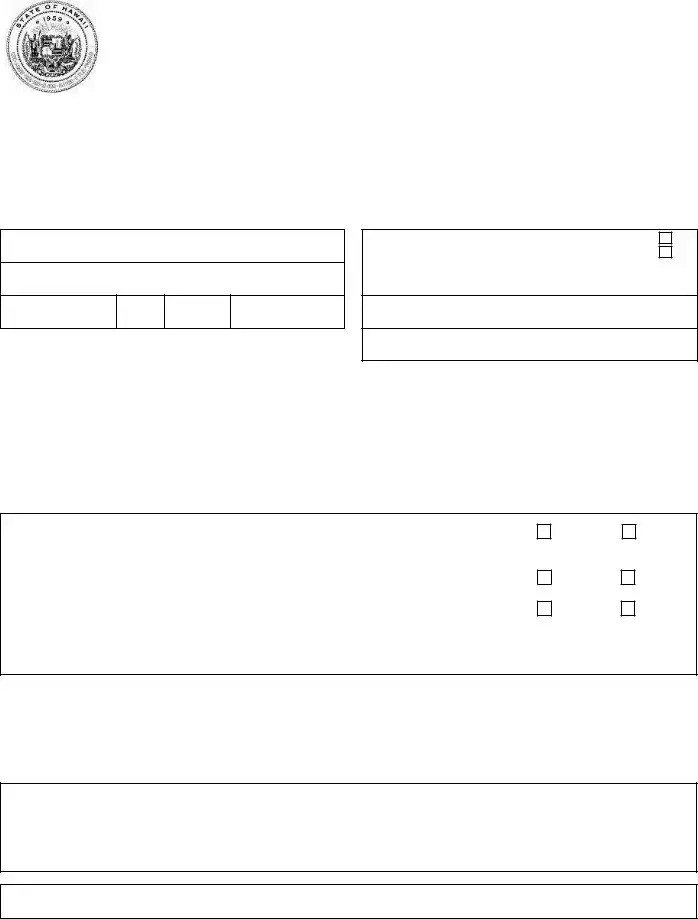

STATE OF HAWAII

PTS DEFERRED COMPENSATION RETIREMENT PLAN

for

ENROLLMENT FORM

Please type or print in ink. Complete ALL information. Failure to complete and return this form may delay or prevent receiv- ing your distribution check after you separate from service.

Send your completed form to:

National Benefits Services, LLC, P.O. Box 6980, West Jordan, UT 84084

SECTION I – IDENTIFYING/EMPLOYMENT INFORMATION

NAME (LAST, FIRST, MIDDLE INITIAL)

ADDRESS

CITY |

STATE ZIP |

HOME PHONE |

HI

SOCIAL SECURITY NUMBER |

DATE OF BIRTH |

M |

|

|

F |

|

|

|

DEPARTMENT |

|

|

UNIVERSITY OF HAWAII

DIVISION/SCHOOL

LEEWARD COMMUNITY COLLEGE

POSITION TITLE(S)

SECTION II – BENEFICIARY INFORMATION (List person to whom you wish to leave your money in case of your death.)

NAME (LAST, FIRST, MIDDLE INITIAL) |

RELATIONSHIP |

SOCIAL SECURITY # |

|

|

|

|

|

ADDRESS |

CITY |

STATE |

ZIP |

|

|

|

|

SECTION III – OTHER EMPLOYMENT INFORMATION

1) |

Are you employed in any other State job(s)? |

Yes |

No |

|

If YES, with what department(s)? _________________________________ |

|

|

|

a) Do these other job(s) provide you membership in the State Employees’ |

Yes |

No |

|

Retirement System (ERS)? |

||

|

|

|

|

2) |

Are you an ERS retiree collecting monthly retirement benefits? |

Yes |

No |

|

|

IMPORTANT: If you answer YES to Questions #1a or #2 above, be sure to notify your employer immediately to prevent problems with payroll deductions related to the PTS Deferred Compensation Retirement Plan.

The Plan Booklet can be made available to individuals who have special needs or who need auxiliary aids for effective communication (i.e., large print or audiotape), as required by the Americans with Disabilities Act of 1990. For more information, please call CFP/LSW at

SECTION IV – SIGNATURE (CERTIFICATION SECTION)

I certify that the above information is accurate. I understand that any incomplete/inaccurate information may result in back taxes and/or penalties imposed by the Internal Revenue Code. A copy of the PTS Deferred Compensation Retirement Plan Employee Information Booklet has been given to me. I understand that I will not contribute to Social Security, but will contribute to Medicare. I understand that 7.5% of my gross wages shall be deducted from each paycheck and deposited into the PTS Deferred Compensation Retirement Plan.

EMPLOYEE’S SIGNATURE |

DATE |

PTS Enrollment Form Rev. 01/10

Document Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to enroll part-time, temporary, and seasonal/casual employees of the State of Hawaii into the PTS Deferred Compensation Retirement Plan. |

| Completion Requirements | Applicants must type or print in ink and complete all sections of the form to prevent delays or issues in receiving distribution checks after service separation. |

| Submission Instructions | The completed form must be sent to National Benefits Services, LLC, at the provided P.O. Box address in West Jordan, Utah. |

| Special Needs Accommodation | The Plan Booklet and assistance are available in accessible formats as required by the Americans with Disabilities Act of 1990, ensuring that all individuals have access to necessary information and services. |

| Contribution Details | Enrollees will not contribute to Social Security, but will contribute to Medicare, with 7.5% of gross wages being deducted from each paycheck for the PTS Deferred Compensation Retirement Plan. |

| Important Notice | Employees are urged to notify their employer if they are employed in any other state job that provides membership in the State Employees’ Retirement System or if they are ERS retirees, to avoid issues with payroll deductions. |

| Governing Law(s) | The enrollment process and the management of the PTS Deferred Compensation Retirement Plan are governed by applicable state laws of Hawaii and federal regulations, including the Internal Revenue Code and the Americans with Disabilities Act of 1990. |

Guidelines on Utilizing Hawaii Pts Enrollment

Enrolling in the Hawaii PTS Deferred Compensation Retirement Plan is a crucial step for part-time, temporary, and seasonal/casual employees of the State who wish to plan for their retirement. This enrollment form is your gateway to ensuring a smoother transaction and management of your retirement funds. It is important to fill out the form carefully and accurately to avoid any delays or issues with receiving your distribution after your service ends. Here’s a straightforward guide on how to complete the form.

- Start with Section I – Identifying/Employment Information. Write your full name (last, first, middle initial) as clearly as possible.

- In the same section, provide your complete address, including city, state, and ZIP code. Ensure the address is current to prevent any mailing issues.

- Fill in your home phone number, Social Security number, and date of birth. Remember, this information is crucial for your enrollment.

- Indicate your gender by marking either M (Male) or F (Female).

- For your employment details, specify the department, such as the University of Hawaii if applicable, and your division/school like Leeward Community College, followed by your position title(s).

- Move to Section II – Beneficiary Information. List the name of the person you wish to leave your money to in case of your death, their relationship to you, their Social Security number, and their full address.

- In Section III – Other Employment Information, answer whether you are employed in any other state jobs by marking Yes or No. If yes, specify the department(s).

- Answer whether these other jobs provide membership in the State Employees’ Retirement System (ERS) by marking Yes or No.

- Indicate if you are an ERS retiree collecting monthly retirement benefits by marking Yes or No. Remember, if you answer YES to questions regarding other state employment or ERS benefits, you must notify your employer to avoid payroll deduction issues.

- Conclude by reading the certification section in Section IV, ensuring you understand the deductions and contributions towards Medicare and not Social Security. Affirm the accuracy of the information provided to ward off any potential consequences related to taxes or penalties by the Internal Revenue Code.

- Sign and date the form at the bottom of Section IV. Your signature certifies that all the information is accurate and that you have received the PTS Deferred Compensation Retirement Plan Employee Information Booklet.

After completing these steps, send your form to National Benefits Services, LLC, P.O. Box 6980, West Jordan, UT 84084. Make sure you keep a copy of the completed form for your records. This enrollment step is foundational for managing your retirement savings and ensuring you have the financial resources available when you decide to retire. Pay close attention to the details, and don’t hesitate to reach out for clarification or assistance if you encounter any doubts during the process.

Understanding Hawaii Pts Enrollment

What is the purpose of the Hawaii PTS Deferred Compensation Retirement Plan Enrollment Form?

The purpose of the Hawaii PTS Enrollment Form is to register part-time, temporary, and seasonal/casual employees of the State of Hawaii for the Deferred Compensation Retirement Plan. By completing this form, employees ensure their enrollment in the retirement savings plan, which allows them to set aside a portion of their earnings, before taxes, for retirement. It is essential to complete all sections accurately to prevent any delays or issues with receiving distribution checks after service separation.

How does one complete the enrollment form?

To complete the enrollment form, one must type or print in ink, filling out all required information. This includes personal identifying and employment information, beneficiary details, and any other relevant job positions within the State that might affect eligibility or contributions to the Plan. Finally, the employee must sign the form, certifying that all provided information is correct and acknowledging the conditions related to contributions and benefits.

What happens if I don't complete all sections of the form?

If all sections of the form are not completed, it may delay or prevent the processing of your retirement distributions after you separate from service. Completing the form accurately and thoroughly is crucial to ensure that you are enrolled properly in the plan and that your savings for retirement are managed according to your employment with the State of Hawaii.

Where should the completed form be sent?

Once the enrollment form is completed, it should be sent to National Benefits Services, LLC, at P.O. Box 6980, West Jordan, UT 84084. Ensure that the form is filled out completely and accurately before sending it to this address to avoid any delays in your enrollment process.

What should I do if I have other State jobs or am an ERS retiree receiving benefits?

If you are employed in another State job or are an ERS retiree collecting monthly retirement benefits, it is important to answer "Yes" to the relevant questions on the form and immediately notify your employer. This is to prevent any issues with payroll deductions relating to the PTS Deferred Compensation Retirement Plan. Proper notification helps ensure that your contributions are managed correctly without affecting your eligibility or benefits under different employment circumstances.

What auxiliary aids are available for individuals with special needs or who need effective communication?

Auxiliary aids for effective communication, such as large print or audiotape, are available as required by the Americans with Disabilities Act of 1990 for individuals with special needs. For more information or to request these aids, you can call CFP/LSW at 596-7006. If you are calling from the neighbor islands, there is a toll-free option available at 1-800-600-7167.

Common mistakes

When filling out the Hawaii PTS Enrollment form, individuals often make mistakes that can delay the processing of their enrollment or affect their benefits in the future. It's essential to complete the form accurately and thoroughly to avoid these pitfalls. Here are six common mistakes:

- Not using ink or typing: The form specifies that it should be completed either by typing or writing in ink. Using pencil or non-permanent writing materials can lead to information being erased or smudged, which can cause processing delays.

- Omitting information in the Identifying/Employment Information section: Every field in this section is crucial, including the full name (last, first, middle initial), address, home phone number, social security number, date of birth, and employment details. Leaving any of these fields blank may prevent the form from being processed correctly.

- Incomplete Beneficiary Information section: Skipping details or not providing the complete social security number and address of the beneficiary might result in complications in the event of the employee's death. It's imperative to list the person clearly to whom you wish to leave your money.

- Ignoring Other Employment Information questions: Failing to disclose other state employment or retirement benefits can lead to issues with payroll deductions and plan eligibility. Answering "Yes" or "No" inaccurately can also have tax implications or result in penalties under the Internal Revenue Code.

- Forgetting to sign and date the Certification section: The employee's signature verifies that all the provided information is accurate. An unsigned form is not valid and will not be processed until this critical step is completed.

- Not notifying employers about other state jobs or ERS benefits: If "Yes" is answered to specific questions in the Other Employment Information section, it is the employee's responsibility to immediately inform their employer. Neglecting to do so can lead to preventable issues with the Deferred Compensation Retirement Plan.

Ensuring completeness and accuracy when filling out the Hawaii PTS Enrollment form is essential for all part-time, temporary, and seasonal/casual employees of the state. Avoiding these common mistakes can help streamline the enrollment process and secure the intended retirement benefits.

Documents used along the form

When enrolling in the Hawaii PTS Deferred Compensation Retirement Plan, participants are often required to navigate through not just the enrollment form but several other documents as well. These documents are crucial for ensuring a comprehensive understanding of the plan, solidifying the participant's enrollment, and safeguarding their financial future. Each of these documents plays a distinct role in the process, ranging from detailing plan specifics to managing beneficiaries and understanding the tax implications.

- Employee Information Booklet: Furnishes detailed information about the plan including eligibility, benefits, investment options, and withdrawal conditions. Essential for making informed decisions about participation and investment.

- Designation of Beneficiary Form: Allows participants to specify individuals or entities as beneficiaries who will receive plan benefits in the event of the participant's death. It's critical to update this document to reflect current wishes.

- Change of Information Form: Used to update personal or employment-related information, such as address, name, or employment status changes. Keeping information current ensures effective communication and proper management of the retirement account.

- Loan Application Form: For participants interested in borrowing against their retirement plan balance under specific conditions. This form outlines terms, eligibility, and repayment requirements.

- Distribution Request Form: Needed when requesting a withdrawal from the plan, whether due to retirement, qualifying hardship, or other eligible events. It includes options for payment and tax withholding preferences.

- Annual Contribution Limits Form: Provides guidance on the maximum allowable contributions to the plan each year, important for tax planning and legal compliance.

The enrollment process in the PTS Deferred Compensation Retirement Plan is designed to be thorough, ensuring that participants are well-informed and their retirement savings are well-protected. Together, these documents facilitate a smooth enrollment experience, enabling participants to make the most of their retirement planning efforts. It's beneficial for participants to review these documents closely, seek clarification when needed, and consult with a financial advisor to align their retirement savings strategy with their long-term financial goals.

Similar forms

The Hawaii PTS Enrollment form is similar to various other documents used in the fields of employment and retirement planning. These documents often share commonalities in their structure, purpose, and information required from an employee or participant. Understanding these similarities can provide clearer insights into their respective functions and the processes they facilitate.

The Federal W-4 Form is one primary document that shares similarities with the Hawaii PTS Enrollment form. Just like the Hawaii form, the Federal W-4 is used by employees to provide necessary information to their employers, including personal and tax information. Both forms require individuals to fill out their name, address, social security number, and employment details. The key difference lies in their primary purpose: while the Hawaii PTS Enrollment form is specific to retirement plan enrollment for part-time, temporary, and seasonal/casual employees, the Federal W-4 focuses on federal income tax withholding preferences. Nonetheless, the similarities in the required personal and employment-related information underscore their roles in ensuring proper management of employee records and financial transactions.

The Beneficiary Designation Form found in many retirement and insurance plans also bears resemblance to the Hawaii PTS Enrollment form, particularly in the sections concerning beneficiary information. Both documents prompt individuals to designate a beneficiary(ies), requiring detailed information such as the beneficiary's name, relationship to the participant, and contact information. This parallel illustrates their mutual aim of providing financial protection and ensuring the intended transfer of assets or benefits upon the participant's death. Despite differing in overall scope, with beneficiary designation forms being more narrowly focused while the PTS Enrollment encompasses broader employment and retirement plan enrollment features, their shared focus on beneficiary information highlights a universal need to plan for the future.

The Employee Information Update Form, commonly used by HR departments to update employee records, also shares common ground with the Hawaii PTS Enrollment form. Both require up-to-date personal and employment information from the employee, such as home address, phone number, and department or position title. This similarity underscores their role in maintaining accurate and current employee records, crucial for effective communication, payroll processing, and benefits administration. However, the PTS Enrollment form is distinct in its focus on the specifics of retirement plan enrollment, whereas the Employee Information Update Form serves a broader purpose of keeping employee records current across various domains.

Dos and Don'ts

Things You Should Do When Filling Out the Hawaii PTS Enrollment Form

Ensure that all sections of the form are completed in full. It's crucial to provide detailed and accurate information in every field to avoid delays or issues with your enrollment.

Use ink and print legibly or type your responses. This helps in preventing misunderstandings or data entry errors that could affect your enrollment status or benefits.

Review the Plan Booklet if you have any special needs or require auxiliary aids for effective communication, as adjustments can be made to accommodate your needs according to the Americans with Disabilities Act of 1990.

Sign the certification section (Section IV) to verify the accuracy of the information you've provided. Your signature also confirms your understanding of the plan's terms, including wage deductions and contributions to Medicare instead of Social Security.

Notify your employer immediately if you are employed in another State job that grants you membership in the State Employees’ Retirement System (ERS) or if you're an ERS retiree collecting benefits, as stated in Section III. This is important to avoid problems with payroll deductions.

Things You Shouldn't Do When Filling Out the Hawaii PTS Enrollment Form

Do not leave any fields blank. Missing information can lead to delays in processing your enrollment form or might prevent you from receiving benefits after separating from service.

Avoid using pencil or non-permanent writing tools. This ensures that your information remains legible and unaltered during processing.

Do not overlook the importance of the beneficiary information in Section II. Ensure you list someone to whom you wish to leave your money in case of your death, along with their accurate and complete details.

Refrain from submitting the form without thoroughly checking for errors or incomplete information. Accuracy is key to a smooth enrollment process and ensuring you receive the correct benefits.

Do not ignore the instructions regarding employment in another State job or ERS retirement benefits. Failing to notify your employer about these situations may result in unintended payroll deduction issues.

Misconceptions

When considering enrollment in the Hawaii PTS Deferred Compensation Retirement Plan for part-time, temporary, and seasonal/casual employees, it's crucial to dispel common misconceptions surrounding the process and benefits. Incorrect assumptions can lead to missed opportunities or misunderstandings about one's retirement savings. Here are nine frequent misconceptions and the truths behind them:

- Completing the form is optional: Every eligible employee should complete the enrollment form fully and accurately. Failing to do so may result in delays or the inability to receive distribution checks after separation from service.

- Personal information is irrelevant: Providing meticulous details, such as identifying/employment information, is crucial. This data ensures that your contributions are correctly recorded and that you can receive benefits in the future.

- Beneficiary information can be skipped: It's a common misconception that listing a beneficiary is unnecessary. However, specifying to whom you wish to leave your money in case of your death is a vital part of retirement planning.

- Other employment doesn't need to be disclosed: The form requires information about any other state jobs you hold and whether they provide membership in the State Employees’ Retirement System (ERS). Accurate disclosure is essential to prevent issues with payroll deductions.

- ERS retirees can't enroll: Ers retirees collecting monthly retirement benefits are often thought to be ineligible. However, the form explicitly asks this question to ensure proper enrollment and contributions.

- No need to inform your employer about other state jobs or ERS benefits: If you answer yes to having other state jobs or collecting ERS benefits, immediately notifying your employer is crucial to avoid problems with your contributions.

- Signing the form is merely a formality: The certification section is where you acknowledge the accuracy of your information, understanding that inaccuracies may lead to tax ramifications. Your signature is a binding confirmation of the form’s contents.

- Social Security contributions will be made: A crucial aspect of the PTS Plan is that contributions go towards Medicare, not Social Security. Understanding the impact this has on your future benefits is important.

- Contribution rates are negotiable: The form explicitly states that 7.5% of your gross wages will be deducted for the retirement plan. This rate is not subject to change and ensures consistent savings towards your retirement.

Addressing these misconceptions head-on ensures that employees are fully informed about their enrollment in the Hawaii PTS Deferred Compensation Retirement Plan, empowering them to make knowledgeable decisions about their retirement savings.

Key takeaways

When filling out the Hawaii PTS Enrollment form, there are several important aspects that part-time, temporary, and seasonal/casual employees of the state need to be aware of to ensure a smooth enrollment process and safeguard their deferred compensation retirement plan. Here are key takeaways for completing and utilizing the form effectively:

- Accuracy is pivotal: The form mandates that all information be typed or neatly printed in ink. Providing accurate and complete details is crucial because any mistakes or omissions can delay or even prevent the disbursement of funds post-separation from service.

- Multiple Sections Require Attention: The form is divided into various sections, each asking for detailed information such as personal identifying details, beneficiary data, and other employment specifics. It's essential to go through each section thoroughly to ensure completeness.

- Beneficiary Information is Critical: Specifying a beneficiary is an important step that should not be overlooked. This detail determines who will receive the money in the unfortunate event of the employee's death. It requires the beneficiary’s name, relationship, social security number, and address.

- Employment Information Matters: Being transparent about other state employment and whether those positions contribute to the State Employees' Retirement System (ERS) is necessary. This helps in avoiding conflicts or issues with payroll deductions related to the PTS Deferred Compensation Retirement Plan.

- Implications for ERS Retirees: The form asks if the enrolling individual is already collecting monthly retirement benefits from ERS. Affirming this requires immediate notification to the employer to prevent any complications with the plan's contributions and deductions.

- Plan Contributions: By signing the form, employees acknowledge and understand that 7.5% of their gross wages will be automatically deducted from each paycheck. These contributions are directed towards the PTS Deferred Compensation Retirement Plan, playing a vital part in building their retirement savings.

- Communication Assistance: The form acknowledges the importance of accessibility and offers assistance for individuals with special needs or those requiring auxiliary aids for effective communication, as mandated by the Americans with Disabilities Act of 1990. Contact information is provided for obtaining plan booklets in accessible formats.

Completing the Hawaii PTS Enrollment form with care and understanding its components not only ensures compliance but also secures employees' future financial wellness. It's a pivotal step in managing one’s deferred compensation and retirement planning effectively.

Create Common PDFs

Hawaii Polst - The document emphasizes that all patients be treated with dignity and respect, regardless of the choices made.

Department of Taxation Hawaii - For adding a Liquor, Cigarette and Tobacco, or any other special tax registration, complete the BB-1X amendment form.

Cslb Meaning - This form is for identifying the employee designated to oversee a company's compliance and operations in Hawaii.